Note: Don’t forget to read and work through our Masterguide to Case Frameworks if you’re still struggling with your profitability case frameworks after reading this article.

Table of Contents

First and foremost, when preparing for profitability case interviews, it’s crucial to develop a strong profitability case framework. Simply relying on generic revenues and costs won’t suffice. Interviewers do not want to hear about merely splitting by revenues and costs, as this is not not how consultants solve problems in the real world.

Inherent to a profitability case is revenues, costs, margins, etc. However, in the real world, do top-tier consultants go into Fortune 500 companies and say “we are going to fix your profitability problem. First we will look at your revenues. Then we will look at your costs”? Of course not! They break down the business into logic segments. They use the context of the firm, the industry, and the overall situation to see through what lens they will analyze revenues and costs.

If you are using revenues and costs as buckets for your frameworks, you need to stop now. Rather, learn how to think through a profitability issue.

Real Life Introduction to the Profitability Case Interview

As you likely already know, a profitability case interview is a type of case study where the primary objective is to analyze a company’s financial performance. The primary aim of a profitability case framework is to identify opportunities for improvement and recommend strategic actions to boost the company’s bottom line.

Real Life Example

Imagine you are married and both you and your spouse each currently have a job with respective salaries.

Your spouse loses their job.

In other words, our “company” has a decline in profits.

Most candidates, if they were approaching this problem like they would a case, they would say “We need to identify the root cause of the problem and fix it”.

Ok, so the root cause is that your spouse was let go due to company downsizing. So, our solution is to fix the company’s downsizing issue in order to get our spouse their job back?

Of course not!

Lesson #1: Do not just do root cause investigation for a profit case interview. Fixing the root cause is not the only way to bring profits back.

Ok, so let’s say you’re interviewing career coaches and financial advisor to help you with this problem.

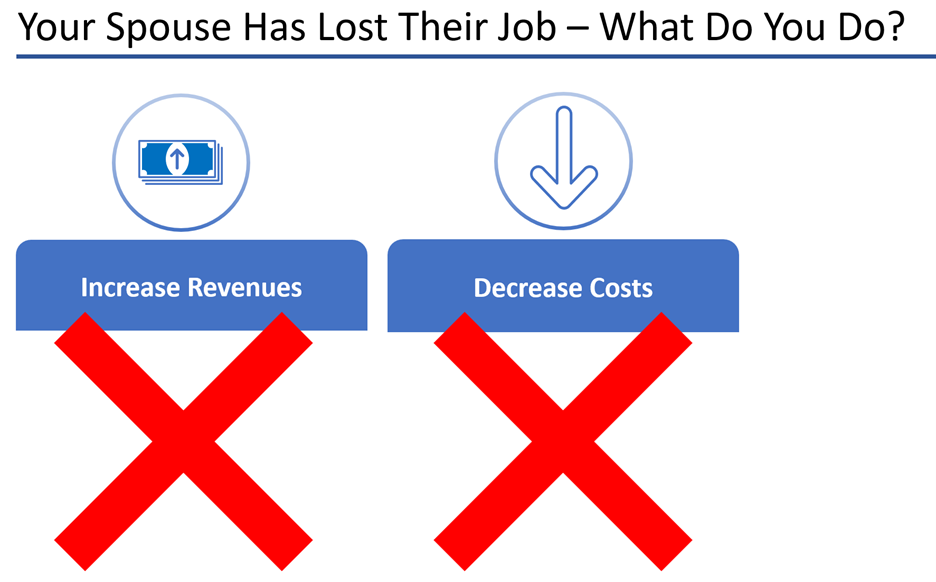

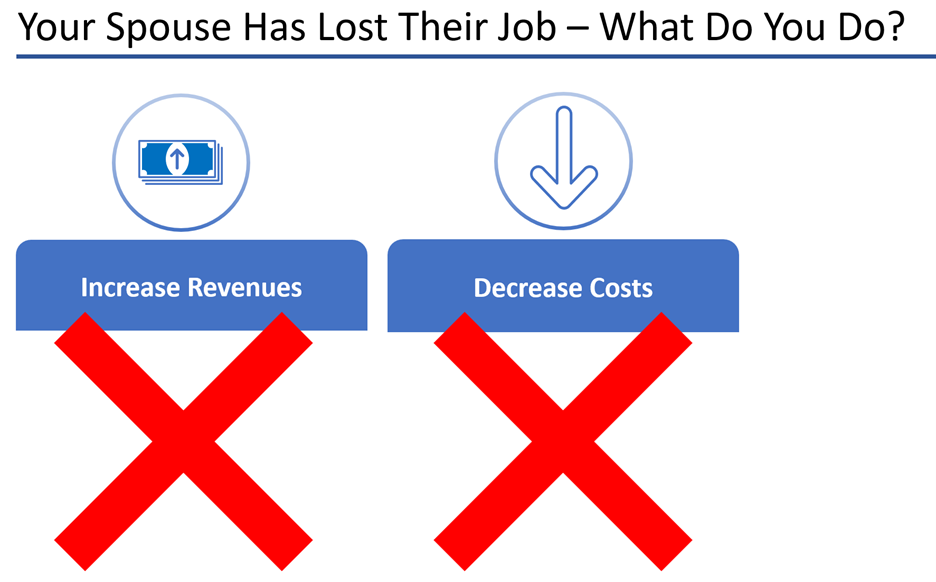

One of them says “I think we should increase your revenues and decrease your costs.”

Are you happy with this approach? Are you willing to pay them to help you fix your problem? Does this inspire confidence? Of course not! Same goes for consulting. A firm does not need to hear you say “Pay us $5M USD and we will fix your problem by increasing your revenues and cutting your costs”.

Lesson #2: Do not use a generic revenue – cost framework. Actually solve the problem.

So what does this look like?

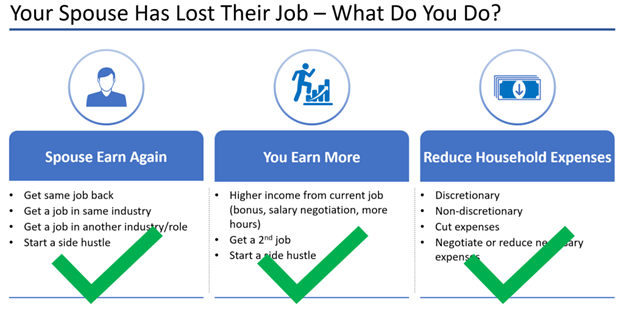

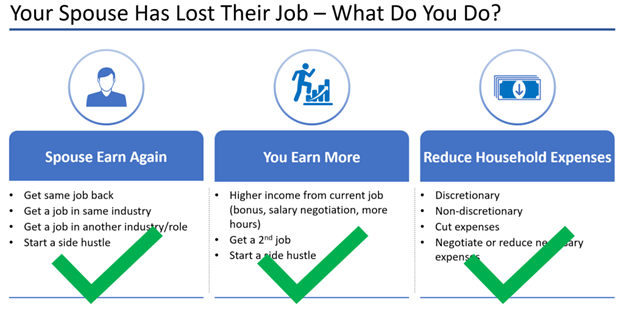

A real career coach or financial advisor would come to you and say “Ok, there are a few ways we can approach this issue. First, we can get your spouse back earning income. This could be in the same field, or part time work elsewhere, or him/her starting their own business. Second, let’s see if we can get you earning more. This could be through increasing your current job’s salary, or by taking on additional work through a second job or side hustle. Finally, all else failing, we need to reduce your household expenses. Let’s break these down by essentials and non-essentials and see what we can both cut and negotiate”.

Would you hire them? Of course! This is a strong framework.

Applying Case Context Lessons to Create Your Profitability Case Framework

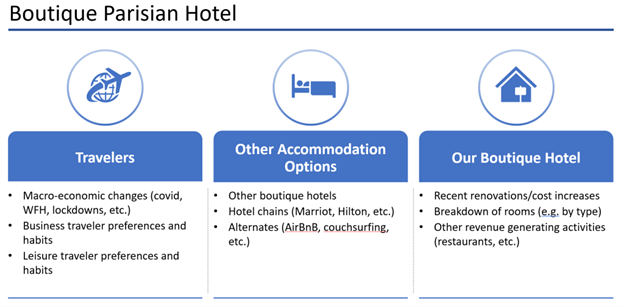

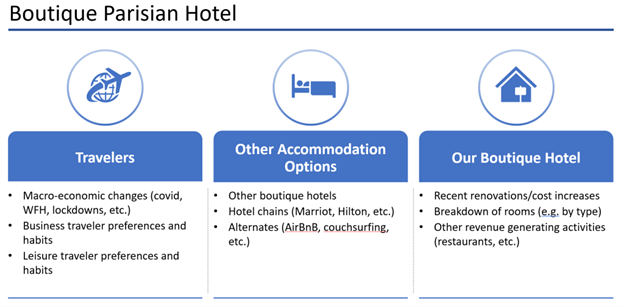

Prompt #1: We are advising a boutique hotel in Paris. They are located in the suburbs. Profits have declined and we have been brought in to investigate.

Profitability case framework option:

For this prompt, we have to look at customers (travelers) because of the very nature of our business. As part of customers (travelers) we have to consider any macro-level forces at play. This bucket works as a merge between external/market and customer.

For the second bucket, we look at all other accommodation options. These could be direct players (other boutiques) and whether new ones have emerged or existing ones have changed what they’re doing. It can also include other types of hotels (chains) or altogether different accommodation options. This is our competitor bucket.

Finally, since we are a single boutique hotel, of course we need to dive into the hotel itself and break down any recent changes and split out our revenues/costs (but in a hotel-specific manner!)

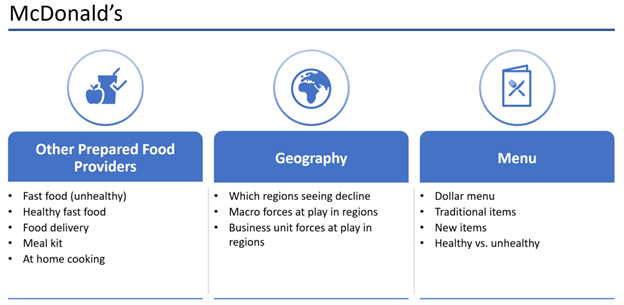

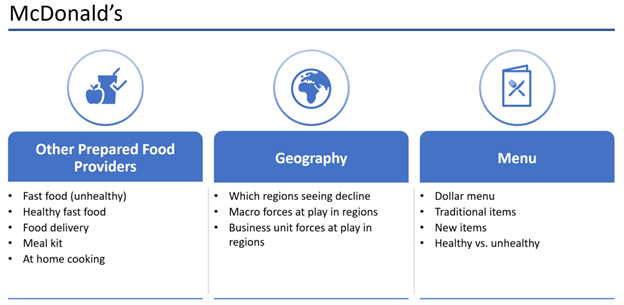

Prompt #2: We are advising McDonald’s. Their profits are down and we need you to bring them back.

Profitability case framework option:

Because McDonald’s is a multinational corporation that operates differently across different regions, we CANNOT just copy-paste our profit case framework from the prior prompt. Rather, while we do still have to look at the market overall (competition + customer trends) in our first bucket, we also need to split our business itself.

The boutique hotel was 1 building. Therefore it can exist as one bucket. However, McDonald’s breaks down its own business by region and we have to do the same! Therefore, our second bucket here is geography, where we have to dive into different geographies based on performance.

Finally, we have our menu itself. McDonald’s not only sells food, but it does so with very noticeable menu specialization. That is, even when it does its own reporting, it breaks down performance across its major menu items (BigMac, McNuggets, etc.) as well as its new launches. As such, a breakdown of menu decisions is critical here.

We are looking at revenues and costs across all of these buckets. That is the exact point!

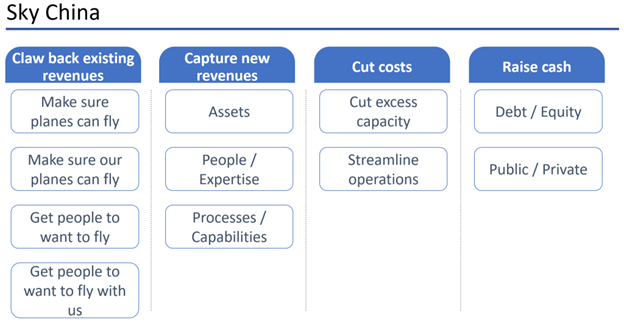

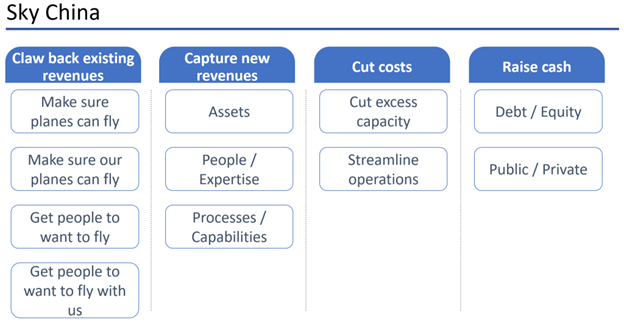

Prompt #3: Sky China is a Chinese airline. It is March 2020 and due to covid-19 they are seeing plummeting profits. They have brought you in to prevent bankruptcy.

Profitability case framework option:

Here, we already know revenue is a big issue. Covid-19 caused flights to be grounded and customers to be afraid of flying. Therefore, our first bucket has to be focused on trying to recover revenues, as much as we can, within our airline business.

We can assume we won’t claw back all revenues, and therefore we have to look at capturing new revenues by leveraging our existing assets, people, and capabilities. This does not incur extra cost, which we can’t afford right now, but just squeezes top-line out of existing assets.

Thirdly, it’s almost guaranteed we will have to cut costs. However, notice how we don’t just say “Costs can be broken down into fixed costs and variable costs”. Who cares! Remember, you need to be a real life consultant in this interview. As such, real consultants would recommend that we first cut all excess capacity; anything not generating revenues needs to go (planes, pilots, etc.). Then, any costs directly associated with revenue-generating activities need to be optimized and streamlined.

Finally, remember again that our job here is to prevent bankruptcy. This is NOT just about profitability. As such, our fourth bucket needs to be focused on liquidity – we need to raise cash. This can be split into debt/equity and public/private markets.

Listen here while I explain this approach to my candidate.

If you’re still struggling to grasp this new approach, listen to how I talk through profitability to my candidate:

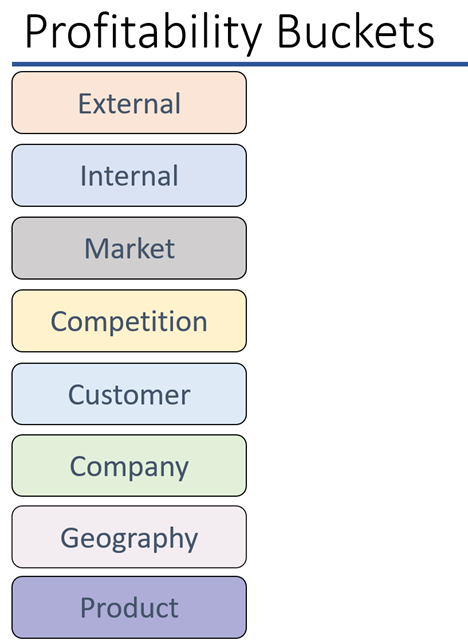

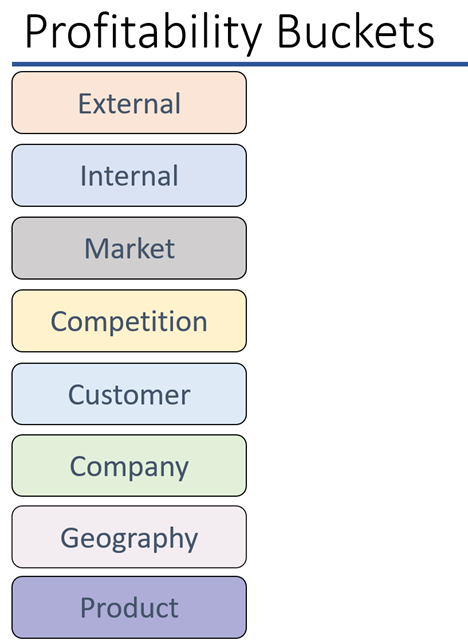

Profitability Case Framework Bucket Options

While we would prefer to not rely on canned frameworks for profitability answers, we can lean on some of the major buckets that can be leveraged. They are as follows:

For the majority of profitability case prompts, you can use some subset/combination of these listed buckets. Of course, make sure to tailor them to the case!

Profitability Case Framework Segmentation #1 - Geographic

Now let’s dive deeper into some options you have for profitability case framework buckets. Please keep in mind that these are only some options. This is not an all encompassing list, but should help you further expand your frameworking ability.

Geographic segmentation involves dividing the market based on location. This can help identify regional trends, differences in customer preferences, and variations in competitive dynamics. The following steps can be followed while conducting a geographic segmentation analysis:

- Identify the relevant geographies: Determine the countries, regions, or cities that are relevant to the business.

- Analyze the market size and growth: Estimate the market size and growth rates for each geographic segment.

- Examine the competitive landscape: Understand the market share, competitors’ positioning, and their strengths and weaknesses in each region.

- Identify regional trends and preferences: Analyze the factors that may influence customer preferences and demand in different regions.

- Evaluate the company’s performance: Assess the company’s performance in each geographic segment, including its market share, revenue growth, and profitability.

- Recommend strategic actions: Based on the analysis, propose targeted actions to improve the company’s performance in each segment.

Profitability Case Framework Segmentation #2 - Customer

Customer segmentation involves dividing the market based on customer characteristics, such as demographics, psychographics, and purchasing behaviors. This can help uncover variations in customer needs and preferences and enable the company to tailor its products and services accordingly. The following steps can be followed while conducting a customer segmentation analysis:

- Identify the relevant customer segments: Determine the customer groups that are relevant to the business, such as age, gender, income, or lifestyle.

- Analyze the market size and growth: Estimate the market size and growth rates for each customer segment.

- Examine the competitive landscape: Understand the market share, competitors’ positioning, and their strengths and weaknesses for each customer group.

- Identify customer preferences and needs: Analyze the factors that influence customer preferences and purchasing behaviors for each segment.

- Evaluate the company’s performance: Assess the company’s performance across the different customer segments, including its market share, revenue growth, and profitability.

- Recommend strategic actions: Based on the analysis, propose targeted actions to enhance the company’s performance within each customer segment.

Profitability Case Framework Segmentation #3 - Competitor

Competitor analysis is an essential aspect of the profitability case framework, as it helps identify the company’s strengths and weaknesses relative to its competitors. This can provide valuable insights into potential opportunities for growth and improvement. The following steps can be followed while conducting a competitor analysis:

- Identify the key competitors: Determine the main competitors in the market and their relative positioning.

- Analyze the competitors’ strategies: Examine the competitors’ growth strategies, including their product offerings, pricing, marketing, and distribution channels.

- Evaluate the competitors’ performance: Assess the competitors’ financial performance, including their revenues, costs, and profitability.

- Identify the competitive advantages: Understand the strengths and weaknesses of each competitor and their unique selling propositions (USPs).

- Examine the competitive dynamics: Analyze the factors that influence the competitive landscape, such as market trends, regulatory changes, and technology advancements.

- Recommend strategic actions: Based on the analysis, propose targeted actions to enhance the company’s competitive advantage.

Profitability Case Framework Segmentation #4 - Product

Analyzing the company’s product mix can reveal valuable insights into its performance across different product categories. This can help identify opportunities for growth, diversification, or optimization. The following steps can be followed while conducting a product mix analysis:

- Identify the product categories: Determine the different product categories offered by the company.

- Analyze the market size and growth: Estimate the market size and growth rates for each product category.

- Examine the competitive landscape: Understand the market share, competitors’ positioning, and their strengths and weaknesses for each product category.

- Identify product-specific trends and preferences: Analyze the factors that influence customer preferences and demand for each product category.

- Evaluate the company’s performance: Assess the company’s performance across the different product categories, including its market share, revenue growth, and profitability.

- Recommend strategic actions: Based on the analysis, propose targeted actions to improve the company’s performance within each product category.

Profitability Case Framework Segmentation #5 - Channel

Examining the company’s channel strategy can provide insights into its performance across different distribution channels. This can help identify opportunities for growth, optimization, or expansion. The following steps can be followed while conducting a channel strategy analysis:

- Identify the distribution channels: Determine the different channels through which the company sells its products or services, such as online, retail, or wholesale.

- Analyze the market size and growth: Estimate the market size and growth rates for each distribution channel.

- Examine the competitive landscape: Understand the market share, competitors’ positioning, and their strengths and weaknesses for each channel.

- Identify channel-specific trends and preferences: Analyze the factors that influence customer preferences and purchasing behaviors for each distribution channel.

- Evaluate the company’s performance: Assess the company’s performance across the different channels, including its market share, revenue growth, and profitability.

- Recommend strategic actions: Based on the analysis, propose targeted actions to improve the company’s performance within each distribution channel.

Common Pitfalls and Mistakes

When conducting a profitability case interview, it’s essential to be aware of the common pitfalls and mistakes that candidates often make. These include:

- Failing to segment the market: Not segmenting the market can lead to overlooking crucial insights and opportunities in specific segments.

- Overlooking external factors: Failing to consider external factors, such as market trends, regulatory changes, and technological advancements, can result in an incomplete analysis.

- Not prioritizing issues: Candidates should prioritize the most critical issues and focus their analysis on the areas with the highest potential for improvement.

- Insufficient data analysis: Candidates must be thorough in their data analysis, ensuring that they draw accurate conclusions and recommendations based on the available information.

- Lack of structure: A well-structured approach is crucial for effectively tackling profitability case interviews. Candidates should use a systematic framework to guide their analysis and ensure that all relevant aspects are covered.

Try For Yourself - Your Own Profitability Case Framework

Think you’re ready now for your profitability case interview? Try out this one here:

How did it go? If you aced it, well done! If you didn’t, don’t worry, we have plenty more exercises and explanations (across not just profitability cases, but growth prompts, unconventional prompts, etc.) in our course here.

Recommended For You

Want to learn how to become a master in frameworking? Found this article useful? We recommend the following to help you level up and get that offer: