Table of Contents

Navigating the world of consulting interviews can be a daunting task. One of the key components that interviewers often focus on is the market sizing case interview. In this comprehensive guide, we will take you through the ins and outs of market sizing case interviews and the way to approach the guaranteed market sizing question. We will provide you with the tools and knowledge necessary to excel in this critical aspect of consulting recruitment.

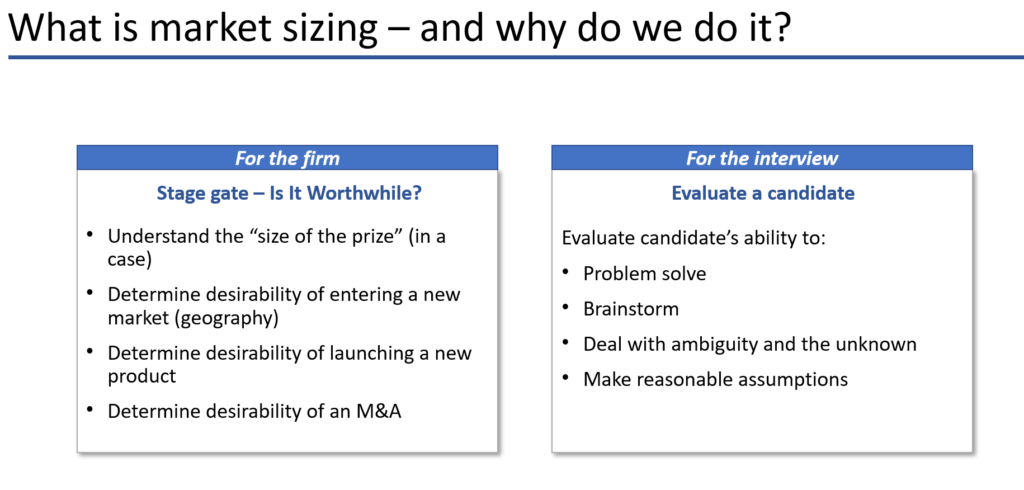

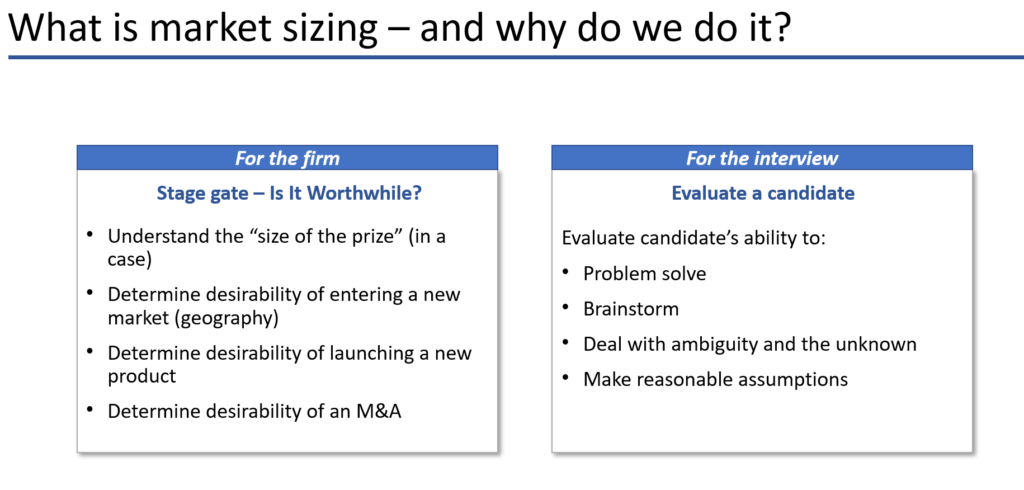

What is Market Sizing?

Market sizing, also known as market estimation, is the process of determining the total potential demand for a specific product or service within a given market. In consulting, market sizing questions are a common component within case interviews, often serving as the first type of question a candidate is asked. These questions might include:

- “How many golf balls can fit into a Boeing 747?”

- “How many coffees does Starbucks sell each day?”

The goal of these questions is not to test the candidate’s ability to recall specific numerical facts but rather to assess their problem-solving and estimation skills in providing a logical and well-reasoned response.

Now, I have a list of real past market sizing questions asked in interviews, all of which is provided during coaching.

Why do Consulting Firms Ask Market Sizing Questions?

First, consultancies ask market sizing questions during interviews because they market size themselves!

Specifically for the candidate, they are looking to see:

- Problem-solving skills: Market sizing questions assess a candidate’s ability to break down complex problems into smaller, more manageable components.

- Analytical skills: These questions test a candidate’s ability to analyze data, make reasonable assumptions, and perform quick calculations.

- Communication skills: Market sizing questions also evaluate a candidate’s ability to clearly articulate their thought process and present their findings in a structured manner.

- Creativity: Candidates must think creatively to find alternative ways to approach the problem and make reasonable assumptions when faced with limited information.

- Prioritization: Market sizing questions test a candidate’s ability to focus on the most relevant information and prioritize their approach to solving the problem.

The #1 Issue With Market Sizing - Guessing

If there is anything you learn from this article, it should be to not guess. Nothing is worse than a candidate completely making up numbers. That’s not the point! The entire point of market sizing is to break down the problem in a way that moves you from guessing and towards estimating.

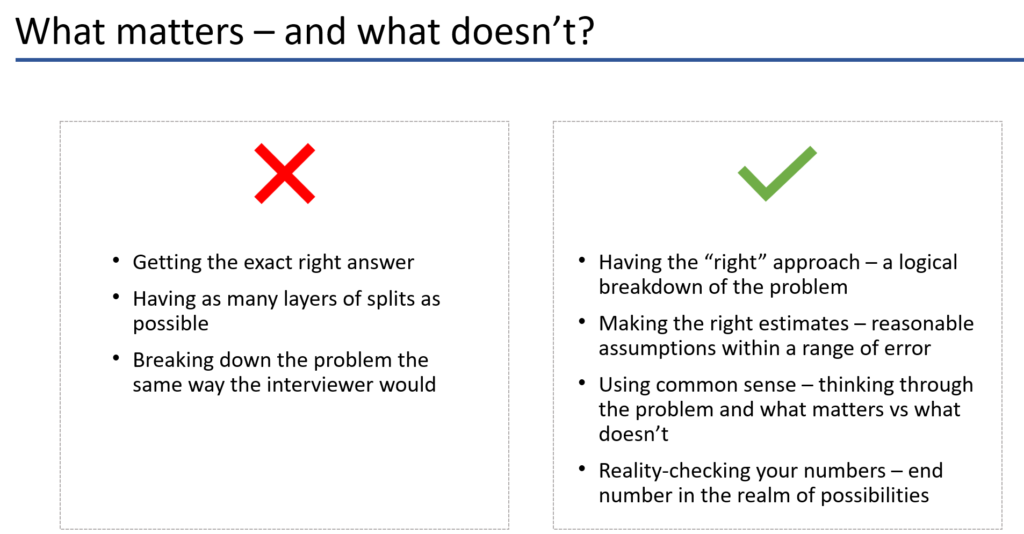

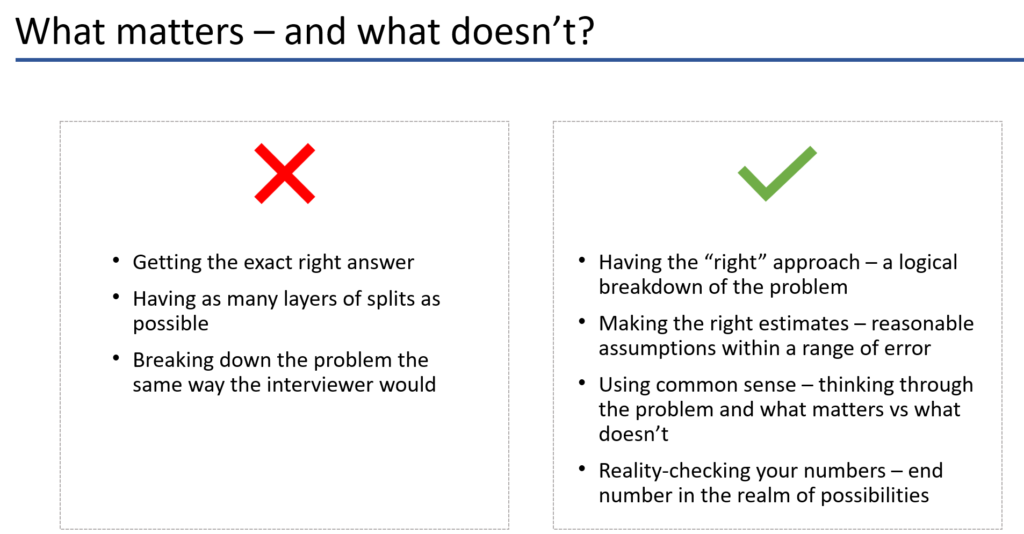

What Matters When Answering Market Sizing Questions

Remember that market sizing questions are just a reflection of what consultants do in the real world, think about what is expected in the real world. You are not expected to get the exact right answer. Nor are you expected to break down the problem into 5 layers or have the same approach as the interviewer. That’s because in the real world, consultants are just looking to have a reasonable estimate of their target market and to have come about this estimate in a logical, defensible way.

Market Sizing Examples

As we go through how to market size, lets just ground ourselves in a few market sizing examples commonly asked in consulting interviews:

- “What is the market size of electric vehicles in the United States?”

- “Estimate the number of smartphones sold worldwide in a year.”

- “How many pizza delivery drivers are there in New York City?”

- “What is the annual revenue of the global pharmaceutical industry?”

Two Approaches to Answering Market Sizing Questions

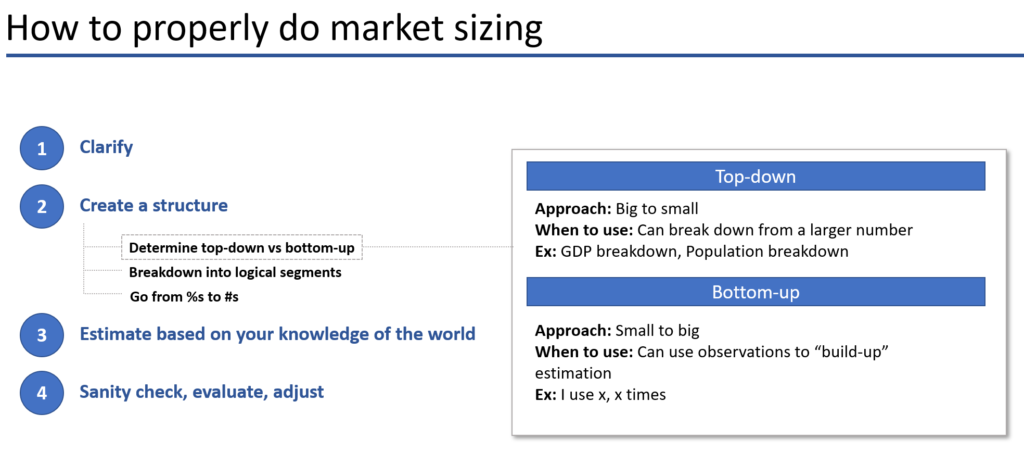

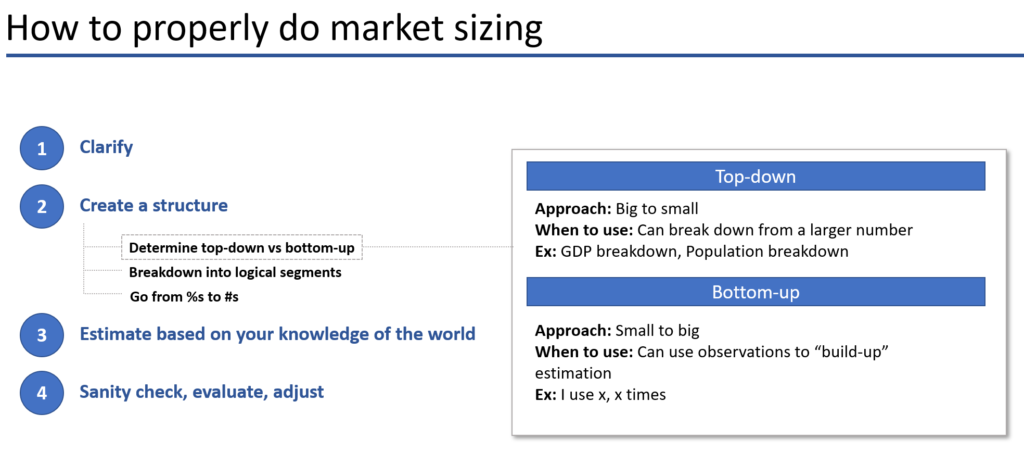

There are two main approaches to tackling market sizing questions during a case interview:

- Top-down approach: This method involves starting with a larger market or population and narrowing it down to the specific segment relevant to the question. This approach is often used when estimating market sizes, such as the number of electric vehicles in the United States.

- Bottom-up approach: This method involves starting with individual units or smaller segments and gradually building up to the total market size. This approach is often used when estimating unit sales or market shares, such as the number of smartphones sold worldwide.

When to use each

Top-down methodologies prove advantageous under the following circumstances:

- When data is limited or time constraints are pressing.

- Estimating the market size for extensive industries or entire market segments.

- Initial high-level market potential assessments before conducting more detailed analysis.

On the other hand, bottom-up approaches shine in the following situations:

- When sufficient data can be gathered from diverse sources.

- Analyzing specific customer segments or niche markets.

- Comprehending intricate market dynamics, such as customer preferences and behavior.

Additionally, demand-side and supply-side analyses serve distinct purposes:

Demand-side analysis proves beneficial when:

- Evaluating customer needs, preferences, and purchasing power.

- Identifying market opportunities and potential target segments.

- Developing customer-centric strategies and value propositions.

Meanwhile, supply-side analysis provides value in the following scenarios:

- Assessing production capacity, scalability, and potential constraints.

- Analyzing the competitive landscape and barriers to entry.

- Understanding distribution channels and logistical considerations.

Four Steps to Answer a Market Sizing Case Interview

Following these seven steps will help candidates answer market sizing questions effectively:

- Clarify the question: Ensure you understand the question fully by asking any necessary clarifying questions.

- Choose an approach: Decide whether a top-down or bottom-up approach is more suitable for the problem at hand.

- Break down the problem and make assumptions: Identify the key components of the problem and break it down into smaller, more manageable parts. Make reasonable and well-informed assumptions to fill in any gaps in your knowledge.

- Perform calculations and sense-check your answer: Use your assumptions and known data to perform calculations and reach a numerical estimate. Check your final answer to ensure it is logical and within a reasonable range based on your assumptions. Adjust if needed.

Key Numbers to Know for Your Management Consulting Interview

Having a general understanding of some key numbers and statistics can be helpful when tackling market sizing questions. These may include:

- World population

- Country populations

- Average household size

- Number of households in a country

- GDP per capita

- Industry market sizes

Remember, the goal is not to have an encyclopedic knowledge of these numbers but rather to familiarize yourself with rough estimates that can help you make reasonable assumptions during market sizing case interviews. The goal is also to make sure you do not come across as ill-informed or poorly read on fundamental/basic numbers relating to the country and region in which you are interviewing.

In the market sizing course we provide you with a full breakdown of these key numbers,

Tips and Tricks for Mastering Market Sizing Estimation Questions

- Practice mental math: Being able to perform calculations quickly and accurately in your head can be a significant advantage during market sizing case interviews.

- Use round numbers: Round numbers are easier to work with and can help you avoid getting bogged down in complex calculations.

- Stay organized: Keep track of your assumptions, calculations, and thought process in a structured manner.

- Remain flexible: Be prepared to adjust your approach or assumptions if new information becomes available or if your initial estimates seem illogical.

- Be confident: Present your findings with confidence, even if you are unsure of your final answer. Interviewers are more interested in your thought process than the specific numerical outcome.

- Determine key levers: Figure out which levers or areas most influence your end number

- Segment: Segment your problem based on those characteristics that more directly relate to the problem. An example here is income directly relating to car purchases

- Don’t Guess. Estimate: Nothing is worse than a candidate completely making up numbers. That’s not the point! The entire point of market sizing is to break down the problem in a way that moves you from guessing and towards estimating.

Market Sizing Examples Part 1: Coffee Shop Revenue

Let’s walk through our first example market sizing case interview question: Estimate the daily revenue of your nearest coffee shop.

Try to solve this on your own first. When you’re ready, watch this video from our course:

Market Sizing Examples Part 2: Active Internet Users

Let’s try the second of our market sizing examples: How many people are using the internet right now? (11am EST Weekday).

Try to solve this on your own first. When you’re ready, watch this video from our course:

Practice Makes Perfect: How to Get Better at Market Sizing

The key to success in market sizing case interviews is practice. Here are some tips to help you improve your skills:

- Study market sizing examples: Review example market sizing questions to become familiar with different types of problems and approaches.

- Practice with a partner: Working with a friend or mentor can provide valuable feedback and help you refine your approach.

- Test yourself: Create your own market sizing questions to challenge your knowledge and assumptions.

- Stay informed: Keep up-to-date with industry trends, market sizes, and key statistics to be better prepared for market sizing questions.

- Use our course: We have multiple market sizing questions and answers for you to practice for yourself. You have already seen a few, but if you’re like to practice more and learn the optimal techniques, check it out!

Conclusion

Market sizing case interviews can be intimidating, but with the right approach and plenty of practice, you can excel in this critical component of consulting recruitment. By understanding the purpose of market sizing questions, familiarizing yourself with key numbers, and following a structured approach to problem-solving, you will be well-equipped to tackle any market sizing question that comes your way. Remember, practice makes perfect, so keep refining your skills and preparing for the challenges ahead. Good luck with your consulting interviews!

Recommended For You

Want to learn how to market size effectively and maximize your chances of passing your interview? Found this article useful? We recommend the following to help you level up and get that offer: